If you live in Tupelo, you know how quickly heavy rain can turn into a problem. Streams like Town Creek or Mud Creek may look calm most days, but one big storm can change everything. That’s why many homeowners need a flood elevation certificate before building, remodeling, or buying property. This document is required for flood insurance and mortgage approvals. But here’s the thing: before you spend money on that certificate, you can now take a quick look at something new from NOAA—the updated Flood Inundation Maps.

What Changed: NOAA’s Street-Level Flood Maps

Until recently, most homeowners only had FEMA flood maps to go by. Those maps are important, but they don’t always show what happens during a sudden heavy rain. In the past few days, NOAA expanded its Flood Inundation Mapping to cover about 60% of the country, including much of Mississippi.

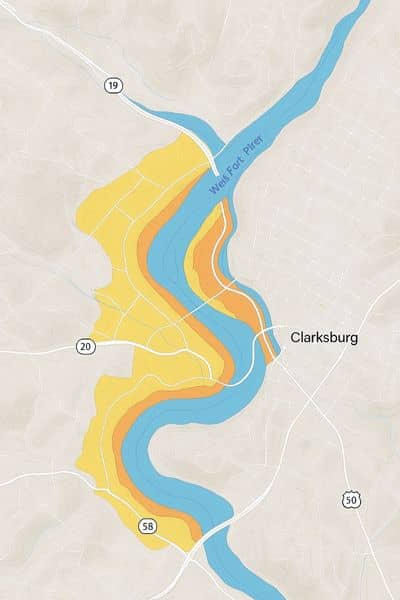

This tool is different because it doesn’t just outline a flood zone—it shows how deep water might get in your neighborhood during a storm. Think of it as a near real-time forecast that zooms all the way down to the street level. You can type in your address, choose a rainfall amount, and see whether water could rise half a foot or more on your block.

That’s a huge deal if you’re thinking about buying a home, refinancing, or even putting up a fence.

Why It Matters Before Ordering a Certificate

The flood elevation certificate is still the gold standard for banks, insurers, and city permits. A licensed land surveyor has to prepare it, and it officially lists the base flood elevation and the height of your home’s lowest floor. Lenders use it to decide insurance rates. The City of Tupelo may require it for new construction near waterways.

But here’s the catch: these surveys cost time and money. If you live in an area where NOAA’s new maps already show clear flood risk, you’ll want to know that before hiring a surveyor. It helps you plan smarter. Maybe you’ll adjust your design, choose a different property, or budget for insurance early.

On the other hand, if NOAA’s map shows no street-level risk, you’ll have more confidence going into the survey process. Either way, checking the free tool first gives you a head start.

How to Use NOAA’s Flood Inundation Map

The process is simple and takes less than five minutes:

- Go to NOAA’s official Flood Inundation Map website.

- Type in your home address or parcel location.

- Toggle the rainfall scenarios—say 6 inches, 12 inches, or more.

- Look at the color overlay to see how deep water could get.

- Save or screenshot the map for your records.

Pair that with an online parcel viewer, and you’ll have a clearer picture of where your lot sits compared to streams, creeks, and low spots. While it doesn’t replace the certificate, it gives you useful context.

FEMA Maps Still Rule the Paperwork

Now, let’s be clear: FEMA’s Flood Insurance Rate Maps (often called FIRMs) are still the official source for compliance. Insurance companies and the city don’t accept NOAA screenshots as proof. Only a surveyor’s flood elevation certificate can be filed with your mortgage or permit application.

FEMA updates these maps through Letters of Map Revision, and in Mississippi those updates can shift neighborhoods in or out of flood zones. That’s why your lender may suddenly require new documents, even if your house hasn’t moved an inch.

So think of NOAA’s map as your early warning system, while FEMA maps and surveyor documents are the legal requirement.

Why You Still Need a Licensed Surveyor

Even with great tools online, only a licensed land surveyor can measure and confirm the exact elevation of your structure. They use field equipment, benchmarks, and records to certify the numbers. That’s what ends up on your flood elevation certificate.

NOAA’s new maps give you a useful preview, but the official paperwork has to come from someone local who understands the area’s requirements. Working with a local surveyor for flood certificates means your results are accurate, accepted by lenders, and recognized by the City of Tupelo. When you also share screenshots from NOAA along with the FEMA panel and your parcel map, you make the process even smoother. That often means fewer site visits, quicker turnaround, and less stress during an already busy time like closing on a house or starting a remodel.

Local Impacts in Tupelo

Tupelo sits in Lee County, and its neighborhoods mix older homes, new subdivisions, and commercial areas. Flood risk isn’t always obvious here. One side of a street might be safe, while the other side dips just enough to collect water.

If you’re planning to build near Town Creek or add onto a home close to Mud Creek, elevation data is critical. The city may ask for a flood elevation certificate before approving permits. Mortgage lenders in the area are also quick to request it if your property is flagged in a FEMA zone.

And remember, flood insurance premiums can vary widely. A certificate showing your home sits higher than the base flood elevation may lower your annual costs. Without that document, insurers often assume the worst and charge more.

Insurance and Peace of Mind

Insurance is one of the biggest reasons people order a flood elevation certificate. Even if you aren’t required to buy flood insurance, the data can protect you. Mississippi storms don’t always follow patterns, and street-level maps show that. A one-time heavy rain could still damage your property, even outside a FEMA zone.

Think of it this way: NOAA’s free maps tell you whether to worry. The flood elevation certificate tells your bank, your insurer, and your city exactly where you stand. Together, they give you a full picture.

Final Thoughts

For homeowners, the smart move is simple: check NOAA’s new Flood Inundation Maps before ordering a flood elevation certificate. It’s fast, it’s free, and it helps you decide your next step.

But don’t stop there. When it comes time to close on a loan, secure insurance, or pull a permit, you’ll still need certified data from a licensed surveyor. That’s where reliable land surveying solutions make the difference—helping you confirm elevations, protect your investment, and move forward with confidence.

By combining NOAA’s tool with FEMA maps and a surveyor’s expertise, you avoid surprises, save money, and make smarter choices about your property. Flood risk is real, but with the right tools—and the right guidance—you can stay one step ahead.