If you’re buying, refinancing, building, or improving a property, you might suddenly hear this sentence: “We need a FEMA elevation certificate.” Most owners don’t expect it. As a result, confusion starts fast. Is it a survey? Is it about flood maps? Is it required for every property?

What a FEMA Elevation Certificate Really Is

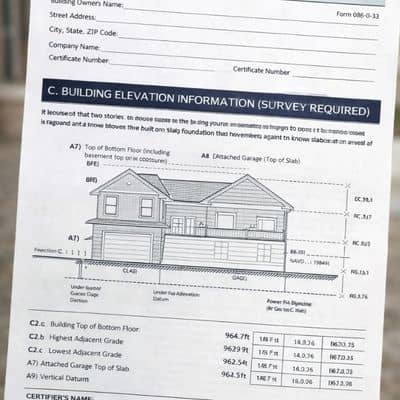

A FEMA elevation certificate is an official document that shows how high a building sits compared to expected flood levels. A licensed surveyor or engineer measures the structure and records key elevation points. Lenders, insurers, and permit offices use those numbers to make decisions.

However, many people mix this up with other surveys. So let’s clear that up.

A FEMA elevation certificate is not:

- a boundary survey

- a property line survey

- a topographic survey

- a general “elevation report”

Instead, it focuses only on the building and specific elevation points tied to flood risk rules.

Because money, permits, and loan approvals depend on it, only licensed professionals can prepare it.

Start Here First: Who Is Asking for It?

Before anything else, find out who requested the FEMA elevation certificate. That one detail usually tells you whether it’s truly required.

Most requests come from one of four places.

First, a mortgage lender or underwriter may ask for it during loan approval. This often appears as a closing condition. If it shows on your loan checklist, you almost always need it.

Second, a flood insurance company may request it before they finalize a policy. They use the building elevation to set the rate correctly.

Third, a city or county permit office may require it before they approve construction or major improvements. This happens often with new builds or large additions.

Finally, a buyer or seller may request it during a property sale. In that case, it supports risk review, not always a legal requirement.

So right away, the source of the request matters.

Property Situations That Usually Require a FEMA Elevation Certificate

Next, let’s look at real property situations. Some scenarios almost always trigger the need for a FEMA elevation certificate.

For example, new home construction often requires one. Permit offices want proof that the finished floor sits at a safe height. Without that proof, they won’t sign off.

Similarly, major structural additions can trigger the requirement. If you expand the footprint or change floor levels, officials often want updated elevation data.

Rebuilding after major damage also brings this up. The same goes for lifting or re-leveling a structure.

Loan closings create another common trigger. If the lender flags flood compliance, they usually want the certificate before funding.

Insurance rewrites also count. When a carrier cannot rate the building correctly, they request the certificate.

On the other hand, small cosmetic remodels rarely trigger this need. Painting, flooring, cabinets, and roofing usually don’t matter here.

Foundation Types That Raise More Questions

Interestingly, the type of foundation often affects whether someone asks for a FEMA elevation certificate.

For instance, slab-on-grade homes get more reviews because the floor sits close to ground level. Small elevation differences matter more.

Crawlspace homes also raise flags. Surveyors must measure inside and outside reference points, so documentation becomes important.

Split-level homes create confusion, too. Lower floors sometimes fall below expected flood levels, so lenders want verified numbers.

Homes on piers or elevated foundations usually perform better. Still, officials often want proof instead of assumptions.

In contrast, upper-floor condos often don’t need individual certificates. The building-level documentation usually covers them. Still, lenders sometimes request unit data, so always confirm.

Projects That Often Trigger the Requirement

Now let’s talk about projects, not just properties.

New construction projects almost always require a FEMA elevation certificate at some stage. Builders submit it before final approval.

Large additions can also trigger it — especially when they change floor height or footprint.

Garage conversions often create issues. When owners turn a lower garage into living space, the lowest floor changes. As a result, officials want new elevation data.

Commercial buildouts sometimes require it as well. This happens more often when the building sits near mapped flood areas.

Site redevelopment projects also trigger reviews, especially when grading changes.

Meanwhile, simple interior remodels usually don’t.

A Quick Reality Check for Owners and Buyers

At this point, you might still wonder: “Do I personally need a FEMA elevation certificate?”

Here’s a practical way to think about it.

You likely need one if a lender lists it as a loan condition. You likely need one if insurance cannot finalize your policy without it. You likely need one if a permit reviewer asks for building elevation proof.

You might not need one if nobody in the loan, insurance, or permit chain requested it. Cash purchases without permits often skip it. Still, always verify before assuming.

In other words, the request — not guesswork — should drive the decision.

What Happens During the Survey Visit

Many owners worry about the site visit. Fortunately, the process stays straightforward.

First, the surveyor reviews the structure and foundation type. Then they take elevation shots using professional equipment. They measure the lowest floor, nearby grade, and key reference points.

Access matters here. Crawlspaces, garages, and exterior corners must stay reachable. Blocked access slows the job.

Most field visits move quickly. However, processing and certification take additional office time. Therefore, don’t wait until the last deadline day to order one.

Timing Matters More Than Most People Think

Deadlines cause most problems with FEMA elevation certificates.

Loan closings often stall when buyers wait too long. Underwriters won’t clear the file without required documents.

Permit approvals also pause when elevation paperwork is missing. That delay can stop construction schedules.

Insurance binders sometimes cannot activate without the certificate. That leaves owners exposed right when they need coverage.

Therefore, order early once someone requests it. Early action prevents last-minute stress.

Common Mistakes That Cause Delays

Several mistakes show up again and again.

Some owners submit the wrong survey type. A topo survey does not replace a FEMA elevation certificate.

Others send outdated certificates from past owners. Lenders often reject those.

Some people assume neighbor data works. It doesn’t. Each structure needs its own measurements.

Finally, some wait until closing week. That almost always causes panic.

Avoid these mistakes and the process stays smooth.

When to Call a Surveyor

If someone officially requests a FEMA elevation certificate, call a licensed surveyor right away. When you call, share the address, the requester, the deadline, and the building type. That information speeds up scheduling and pricing.

Most importantly, don’t guess. Confirm the requirement, then act.

A FEMA elevation certificate may sound technical. However, when you understand the triggers, the process becomes clear. Step by step, you can decide correctly, avoid delays, and keep your project or closing on track.